With all the competition out there, it can be difficult to find the commercial mortgage that is right for your unique needs. Here at MortgageDepot, we take a personalized approach, and we have the options to offer you that will ensure you come to an optimal decision.

Helping You Make Tough Decisions

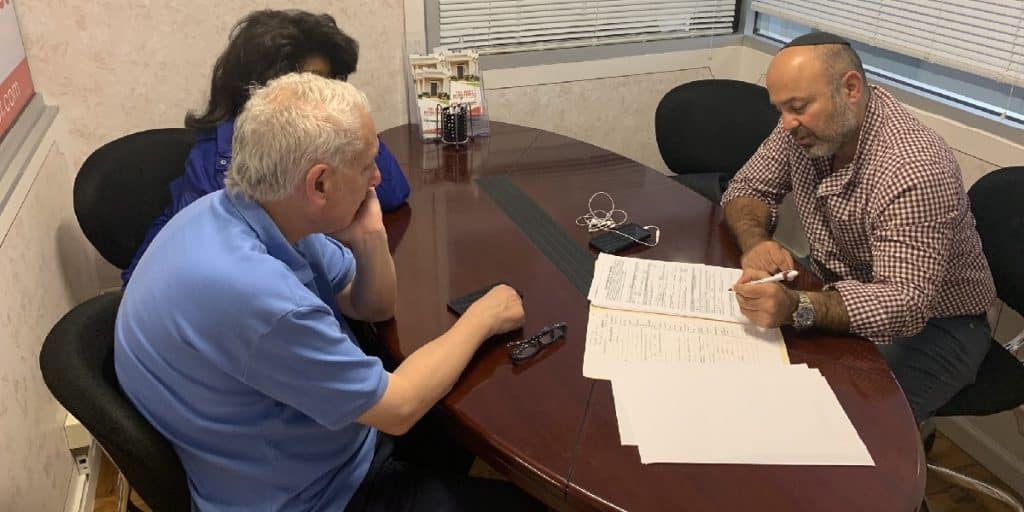

Many new to commercial mortgages don’t realize that they will likely not be allowed to take out a second mortgage. Because of this, it’s highly important that you properly analyze your financial situation before you decide on the amount you should apply for. You should also come prepared to put down a sufficient down payment. This percentage is normally between 20 and 25. Our staff is able to sit down with you and discuss these details to ensure you know where you should be sitting financially prior to acquisition.

Considering Unforeseen Events

All too often, businesses find they do not have the proper finances to remain in the market, and this is devastating. Because of that, it is often advised that small business owners actually apply for more than they need. This provides a financial cushion for you to fall back on to ensure the temporary relief you may need when the going gets tough. This often makes or breaks businesses, and a viable commercial mortgage can make all the difference.

A Business Relationship You Can Count On

Your business is your livelihood. Whether you are starting a new venture or are looking to expand, our experienced staff here at MortgageDepot have your best interests in mind. Growing business activity is crucial to the further development of our economy, and we take pride in helping you achieve your dreams while providing new and exciting jobs. Call or stop by today to see how we can put our knowledge to work for you.

Have questions or need help?

Call us now at 800-220-LOAN

Request a call back or email us your questions!